Dr Gopal Narayanamurthy's research identifies uncertainties affecting institutional crop credit management in India and highlights the benefits of integrating Satellite Imagery Analytics (SIA) based monitoring into the process.

Can technology-driven innovations help achieve financial inclusion of small-scale farmers in developing economies? Can Satellite Imagery Analytics contribute to better and fairer decision making by institutional lenders?

Gopal's research looks at these questions by exploring how SIA can reduce uncertainties in the agriculture financing and banking sector in India.

A series of interviews with key stakeholders, including institutional credit providers, farmers, informal moneylenders, policy makers, technology experts, agriculture academics and think tanks revealed important access barriers to institutional credit for Indian farmers.

Following an identification of the main uncertainties surrounding the agricultural lending system, potential solutions were found in a further longitudinal case study of an Indian SIA firm.

The study confirms the potential of SIA to reengineer the institutional agricultural lending ecosystem, by informing pre- and post-disbursement decisions with realtime data on topographic changes and crop price trends.

Gopal's study sheds light on how technology-driven social innovations can reduce uncertainties and help increase the financial inclusion of small-scale economic actors.

It also offers lending institutions solutions to current monitoring and verification inefficiencies, as well as highlighting the potential to expand bankers’ portfolios, through more profitable borrowers.

Challenging access to institutional credit

Following a series of interviews with key stakeholders1, the study’s findings confirm general trends in agricultural financing in developing countries.

Respondents described a market heavily dominated by informal lending, especially for small-scale farmers, who also face substantial difficulties in accessing institutional credit in the form of bank loans.

This is particularly relevant in India, where over 60% of loans in agriculture are dependent on non-institutional credit from unofficial moneylenders.

As a result, Indian farmers are at greater risk of falling into a debt trap, which contributes to lowered incomes, caused by overspending on non-revenue generating activities, and relatively high suicide rates.

The situation is exacerbated at times by bank managers, as they have a final say on the disbursal decision and have the power to discriminate against borrowers based on caste, gender or religion.

Lack of data and negligible monitoring

From the banks’ perspective, it was found that one of the biggest roadblocks to the expansion of institutional credit has been the lack of reliable data on the historical performance of farmers.

Estimating their creditworthiness represents a key challenge for institutional credit providers, as pre- and post-disbursal monitoring of individual farm-level data is currently done through on-site inspections, with insufficient staff numbers.

This reduces their ability to assess the legitimacy of credit requests, and identify fraudulent cases in which funds are diverted to other purposes, such as marriage and children's education, or providing informal loans to others to earn a profit.

Institutionalised financing processes are further complicated by the overwhelming dependence on a timely monsoon for reasonable yields and susceptibility to extreme weather.

Overall, the unviability of farming, coupled with the fear of increasing nonperforming assets (NPAs), reduces the financial institutions’ lending capacity.

Data-driven approach to reduce uncertainties

In an effort to find solutions to these hindrances, Gopal analysed how uncertainties affecting the expansion of institutional crop credit can be tackled through a data-driven approach, using SIA.

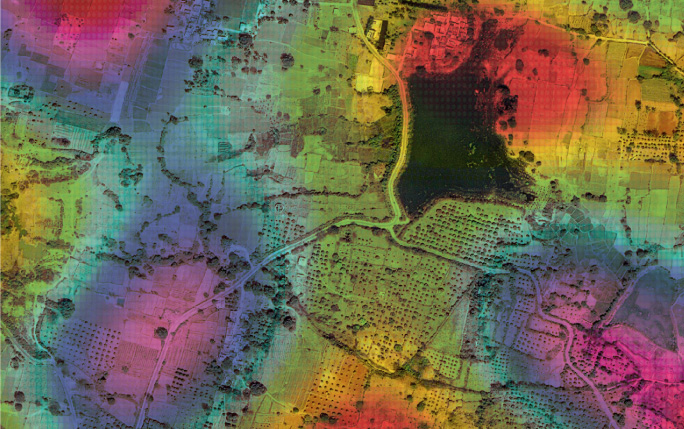

How do Satellite Imagery Analytics (SIA) transform imagery into intelligence?

Satellite images are digital images of the Earth’s surface captured by special-purpose satellites operated by governments and businesses around the world.

These images are often characterised as data that is having volume, variety, and velocity, which are the key characteristics of big data.

SIA consists in the tracking and measuring different types of human and natural activity across the planet, through the analysis of big data obtained from satellite images.

Satellite images are digital images of the Earth’s surface captured by special-purpose satellites operated by governments and businesses around the world.

Satellite sensors can capture invisible types of light (eg infrared, ultraviolet), reflected by objects.

As objects react differently to different wavelengths of radiation, satellite images make much easier to accurately identify these objects and detect variations affecting them than regular images.

SIA is commonly used in meteorology, oceanography, fishing, agriculture, biodiversity conservation, forestry, landscape, geology, cartography, regional planning, education, intelligence and warfare.

During the loan application stage, the verification process was simplified and automated by using crop life cycle and loan cycle related data, captured by SIA technology, in combination with farm loan application and other existing information.

Key insights included real time insights on soil moisture, cropped acreage, availability of ground and surface water, weather data, yield predictions and price movements, which assisted bankers in making better-informed and nondiscriminatory decisions.

Although field inspections at pre- and post-disbursal stages are still necessary, the topographic data picked from satellites, enabled workload distributions to be more efficient, accurate and targeted.

SIA enabled the immediate identification of wilful delinquency from loan beneficiaries not using the money for farming purposes, and allowed decision makers to reject applicants lacking a reasonable cultivation history.

Reengineering of the institutional credit ecosystem

The study results highlight not only the direct benefits of implementing SIA technology for financial institutions, through increased simplification and accuracy of the verification/monitoring system, but also its indirect impact on uncertainty reduction and social inclusion.

The major benefit for institutional loan providers is expanded and better-quality client portfolios, as SIA enables them to attract and reward profitable farmers, while also reducing risk through more effective identification of NPAs and deviations in cropping activities.

Although farmers do not directly benefit from SIA implementation, they are the indirect and ultimate beneficiaries, as it can eliminate major access barriers to institutional credit and reduce discrimination due to non-financial reasons.

The study reinforces support for collective development of technology driven social innovations, as they could transform farming ecosystems in developing nations by improving farm level outcomes and the socio-economic conditions of farmers.

1 Institutional credit providers, farmers, informal moneylenders, policy makers, technology experts and agriculture academics/think tanks.

|

Dr Gopalakrishnan Narayanamurthy Senior Lecturer in Operations and Supply Chain Management |