WATCH: Professor Costas Milas predicts timid UK GDP growth from mid-2024

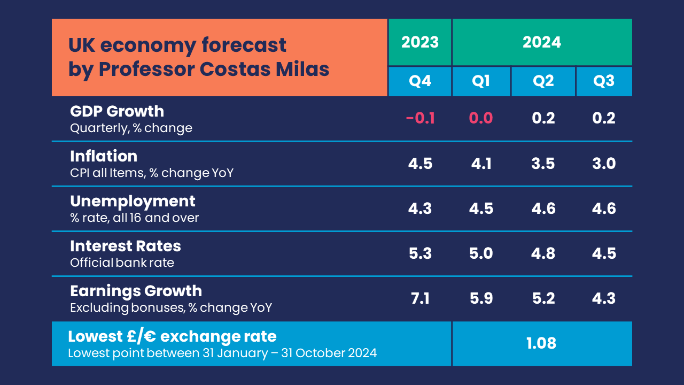

Professor Costas Milas predicts a mild recovery for the UK economy in 2024 and anticipates GDP will not begin to grow until the middle of the year.

The School’s financial economist presented his forecast alongside Professor Michael Kitson and Dr Emily Whitehouse, as part of the 12th Annual Clash of the Titans Forecasting Event organised by the Economic Research Council on 14 December 2023.

Slight economic recovery by mid-2024

According to Costas’ prediction, the UK will have to wait until the middle of 2024 to see the first signs of economic revival.

As 2024 progresses, Costas expects the UK economy to go from a flat 0.0% GDP early in the year, to a slight increase to 0.2% in the second and third quarters.

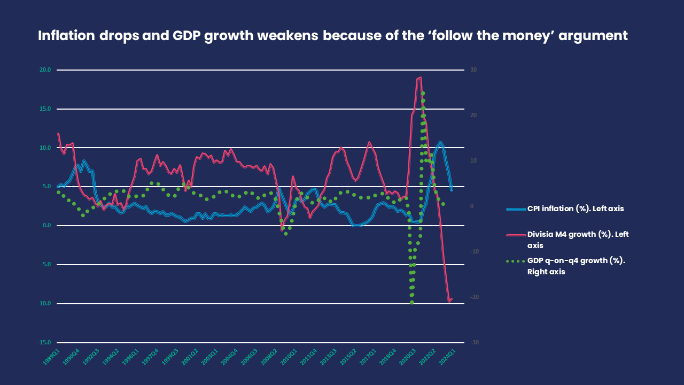

His forecast, which partly draws on joint empirical work with Management School researcher, Dr Mike Ellington, is largely based on the ‘follow the money’ argument.

As highlighted by Costas in previous analysis, while more money stimulates the economy, it also leads to higher inflation. Likewise, higher interest rates can trigger an economic slowdown due to reduced liquidity.

The Bank of England (BoE) has raised interest rates since late 2021, to meet their 2% inflation target, but according to Costas’ analysis this has shrunk the UK’s money supply too.

To explain this, he used the Divisia M4 index, a money liquidity aggregate of a broad range of money supply sources, which are weighted differently depending on how likely they are to be held for transactions when interest rates go up.

For example, when interest rates increase, investors are less inclined to cash in long term bonds, therefore these would be assigned a lower weight than other transaction-ready sources of money, such as cash or deposits in current accounts.

Costas noted the Divisia M4 index has turned negative since early 2023, which translates into less money liquidity.

According to Costas, this will drag inflation down faster than the BoE expectation, and as prices and the amount of money reduce, the UK economy will struggle to grow at a faster pace.

However, from mid-2024 Costas foresees GDP growth to pick up following cuts in interest rates, as already hinted at by the BoE, from the current 5.25% to 5% in March, and then down to 4.5% in the third quarter of the year.

Costas also stressed the positive impact of a slight improvement in EU growth, from 0.6% in 2023 to an expected 1.3% in 2024.

Although mild, the customs union’s economic recovery is good news for the UK, as 42% of its exports go to countries within the EU.

Inflation reduces and real wages stay positive as the shadow of unemployment remains

Despite a sluggish economic recovery, Costas expects inflation to decrease from the current 4% to 3% in autumn.

While this is long-awaited by businesses and consumers, he also foresees unemployment to rise to 4.6%, as a consequence of a weak start to the year for the UK economy.

Although his prediction is based on Office of National Statistics estimates, Costas warns the official rate may not reflect the real levels of unemployment due to survey issues.

This means an improvement in data collection could distort his forecast and uncover a gloomier picture for UK employees, with an unemployment rate higher and much more consistent with weakness in GDP.

Costas also anticipates wage growth to fall, but to stay above inflation, which means real wage growth (earnings growth minus inflation) remains positive.

However, he cautions that robust real wage growth requires productivity gains, which are currently held back due to weak business investment.

The impact of the next general election

Within the forecast, Costas highlighted rising uncertainty linked to the upcoming general election as a potential ‘Black Swan Event’ which might upset his predictions, specifically if PM Rishi Sunak delays the call until January 2025.

With a delayed election date, he argues the focus stays away from the issues that really matter to the UK economy, such as low productivity and how to attract more investment, particularly foreign direct investment.

Costas warns in a scenario of increasing political instability (following five Prime Ministers and seven Chancellor of the Exchequers since 2010), the last thing businesses are going to do is invest in the UK.