We have to be fair when we enter the constitutional debate. There is no point examining and debating such a consequential issue and doing so without evidence, the rigour of argument and also some respect for your opponent. I do have respect for Sinn Fein and this is the reason why – they do at times refuse to sugar coat the 26 counties. That is an example of the obvious difference between republicanism and nationalism – the former about creating for all and the latter more emotional and impassive.

But there is a caveat Sinn Fein put up their arguments in 2 ways. Their manifesto and media interviews takes on the elite and the shoddiness of 26 county neo-liberalism. While their papers on Irish unity say much less about that. The challenge is that if you call for debate and say different things in different documents and places then those who oppose you are find that problematic then you should respond positively. Although, I must reiterate my previous point, unlike others calling for a united Ireland, Sinn Fein know that the southern state is not ready for unification or that a lot of work has to be undertaken to make unification worthwhile for everybody. That is if we actually end up in that space.

So if we are going to debate and in so doing look at the 26 counties properly then there are places and data upon which we agree. We should co-join those unionists and republicans who are prepared to hold up a mirror to the failings of both states. For me that is about making Northern Ireland work and for republicans it is about creating a New Ireland. So if we say the same things about each place (poverty, exclusion, neo-liberalism etc.) then we start the debate not in the Orwellian North is bad, South is better but instead imagine and deliver the capacity to engage in a debate that is much more nuanced. We share somethings and therefore let us move onto what we disagree upon. Instead, of the Orwellian hot air that is essentially British or Irish nationalism clashing over which of the two states is failing better than the other.

So when debating with Sinn Fein and others can we agree that the following concerns that I have are shared? Well by us at least! If what is below is wrong then please tell me how. I have added some questions for your consideration. I genuinely would love answers.

1.Some say the Westminster Subvention is: £10 billion (NI is a backwater and propped up) but also that it is £2 billion (Hmm! NI is not a backwater and would not be a drag on Irish taxpayers). The figure is probably £8.5 billion. Costing the UK taxpayer around £250 per head. In a united Ireland that figure in per capital terms would rise to c£3,2000. Can we agree a figure or agree to disagree?

2.All will be well in the New Ireland the economy will grow: As Fitzgerald and Morgenroth state unification would lead to the ‘firing approximately 50,000 public servants in the North’. Are they wrong? If so why?

3.Ireland can absorb unification: Not according to those academics in the Republic of Ireland who state ‘While the Irish economy is much stronger today than in 1983, funding the Northern Ireland deficit would pose a massive challenge for Ireland…Based on the experience in dealing with the financial crisis in Ireland, to fund the necessary transfer would require a fiscal adjustment in Ireland amounting €20 billion to €30 billion’. If the transfer to Northern Ireland were all funded by increasing direct taxes in Ireland, using the HERMES model it is estimated that this would reduce GNI by around 4% and also reduce consumption per head by around 9% and employment in Ireland by around 4%. Yet again, is their conclusion flawed?

4.The NHS is in crisis: Without doubt. But according to the National Treatment Purchase Fund 819,000 Irish citizens are on waiting lists. That is equivalent to 27% of the population waiting for treatment. In NI the equivalent of 20% are waiting for hospital appointments. Can a New Ireland change this? If so how?

5.People earn more in the Republic: This is true but yet again we are told nothing about the cost of living. Say you are a young couple in NI and you are entering the housing market. The average price of a house in NI is £141k. Your counterpart in Ireland is forking out, on average, £269k. What does that mean? A mortgage that is 90% higher. So a Dubliner may earn 40% more but they have a hell of a mortgage to pay. As Eurostat noted in the 2020 report entitled Housing Visualised:

“The highest housing costs in 2019 compared to the EU average were found in Ireland (77pc above the EU average).”

6. Chocky Biscuits are important. A packet of 30 Jaffa cakes in NI is £2 in the Republic £2.65. Why did ASDA not build stores in the Republic? Because southern consumers flocked to their stores on the border for cheaper prices. Here are some other estimated price differences.

|

Consumer Prices in Dublin are 29.81% higher than in Belfast (without rent) |

|

Consumer Prices Including Rent in Dublin are 62.48% higher than in Belfast |

|

Rent Prices in Dublin are 152.84% higher than in Belfast |

|

Restaurant Prices in Dublin are 18.21% higher than in Belfast |

|

Groceries Prices in Dublin are 23.82% higher than in Belfast |

|

Local Purchasing Power in Dublin is 18.84% lower than in Belfast |

|

Basic (Electricity, Heating, Cooling, Water, Garbage) for 85m2 Apartment in Dublin is 47.3% higher than in Belfast |

|

Preschool (or Kindergarten), Full Day, Private, Monthly for 1 Child in Dublin is 48% higher than in Belfast |

Why is the cost of living so much lower in NI? Simply this – it is part of the UK with 70 million consumers compared to the Republic of Ireland. More consumers in your domestic market means lower costs of living. Why is the cost of living so high in the south? How would you guarantee better standards of living?

6.Such a dreadful place that North: If this is the case then why do so many people living in the South, the country in which they pay tax, engage in cross-border fraud? According to the 2011 census, the population of NI was c1.8 million. But there are medical cards registered to addresses in NI c80,000 higher than the population. And 20,000 of these are believed to be in the Derry. One house in south Armagh had 16 people registered to it despite the premises only having two bedrooms. The minimum amount of taxpayers' money being drained from the service due to fraudulent registration is in the region of £48m and could be as high as £100m a year. Those figures – coupled with other types of fraud highlighted by the health service – indicate the £250m estimate may well be conservative. Also, what about the pupils who live in Ireland and avail of schools in NI? Does this not illustrate NI’s public services should be protected and build to a higher level of social protection? How will you take on the Royal College of Surgeons in Ireland and the private insurance industry? A note of caution. If you de-privatise health the medical professionals may jump out of the new system and just stay private and there will be a lack of staff.

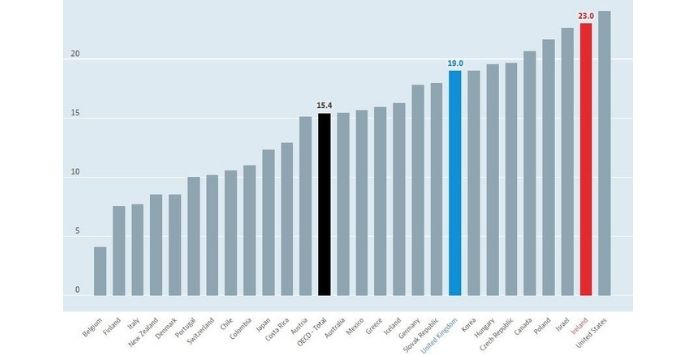

7.The High Incidence of low pay in NI: Yep that is the case and depressingly so. But a recent OECD report suggests that the Irish Republic now has a greater proportion of poorly paid workers than most other developed countries. Look at the graph below. The share of workers whose earnings are below two-thirds of their country's median income is 2nd only the USA. Ireland is on 23 per cent. Of course, the National Minimum in Ireland compared to the UK is higher but the share of workers on low pay is 3% lower in the UK. How will you ensure nobody is part of the working poor?

8.There is so much homelessness in NI: Again yes and shockingly so. Before the pandemic broke. 10,000 people were officially homeless in the Ireland and 40% were children. Can we ensure near zero homelessness?

9.The plight of rural NI: The western and remote parts of NI are the poorest. I recently drove through Augher, Clougher and Fivemiletown and saw open shops and even investment. Then on the way to Galway I went through town after town. Shops and pubs closed and boarded up. No sense of community as witnessed when I drove ‘6 miles up and 7 miles down’. Not a process of research we would stand over but an important point is this – when I related that story to posh Dubliners one remarked ‘those places are for tourism’. If they do not care about the citizens of the 26 then how we can be confident they will care about the North? In Ireland, in the Border, Midlands and West regions there is a much higher number of those living in poverty. In fact, the Eastern and Southern regions of Ireland fewer than 50 percent of the people per capita live in poverty when compared with their rural counterparts.How will you eradiate rural poverty?

10.Growth is sluggish in Northern Ireland: Yep, but it is not contrived. Nobel Prize–winning economist Paul Krugman and others have shown that the long-term distortion of Irish economic data grew the past few decades due to tax-driven accounting flows. Basically Ireland looks wealthier than it is due to being a form of a tax haven. This was so significant that in 2016-17 the Irish Central Statistics Office had to delay and redact information. It was shown that tax-evasion or transfer pricing operations in Ireland accounted for the largest ever base erosion and profit shifting (BEPS) action and the largest hybrid–tax inversion of a U.S. corporation. This has had follow on consequences. In 2017, the U.S and the EU introduced countermeasures to Irish BEPS tools. In October 2018, Ireland introduced a "reverse tax", to discourage IP from leaving Ireland.] In 2018, the OECD showed Ireland's public "debt metrics" differ dramatically depending on whether Debt-to-GDP, Debt-to-GNI* or Debt-per-Capita is used; and in 2019, the IMF estimated 60 per cent of Irish foreign direct investment was "phantom". Will you stop transfer pricing and such evidenced misbehaviour?

As noted in the press at that time:

The addition of billions of euro to the capital stock boosted GDP. Exports of pharmachem products also rose by €13bn in that year, an increase that was probably explained in good part by the shift in intellectual property assets. There was always the possibility that clever accountants in these firms would move the assets again if they found a more efficient way to minimise their worldwide tax liabilities.

If that were to happen, Irish GDP could record a big fall. That, in turn, would make the government's debt position look much more precarious (the measure markets look at most closely is debt as a percentage of GDP).

Conclusion: You may disagree, probably about the subvention, but in general I am saying what you are. Join in saying this together and please let’s shift the debate and do not dismiss the concerns that I have which ironically you have also. Then we can discuss what it is makes me feel why Northern Ireland should remain in the UK. It is the neo-liberal state in Ireland that is problematic to me and many in my generation. I think it important to say that being pro-union is not a barrier to a more just society but instead the real impediment are the issues above. As I say agree that we are saying the same thing about the same place and we will forge ahead of those who aim for romanticised British and Irish nationalism. NI may remain or it may go but we can at least start a discussion that is not just rhetorical tennis.

Back to: Institute of Irish Studies