Exponential Investor highlights IFAM collaboration with Stable

Exponential Investor, a professional publisher advising investors who are looking for new investment opportunities, has recently interviewed Richard Counsell, founder and CEO of Stable, a startup that’s looking to help farmers cope with fluctuating commodity prices.

The article (which you can read here) highlights their collaboration with , whose team used machine learning and multiple algorithms to run millions of simulations analysing decades of Government data.

“Stable” is an agricultural insurance that helps a wide range of farming businesses protect themselves from volatile prices and costs. It's all based on public indexes from Government organizations like the AHDB and DEFRA. The reasons Stable is introduced are:

- There is no good market for agricultural insurances on price fluctuations in the UK.

- There are only derivatives on arable in the EU that are not insurance; since insurances are not for speculation (must be issued at an amount for clients) and they have different markets.

- Brexit and the removal of the common agricultural policy can eventually damage livestock businesses in the UK and in particular Wales.

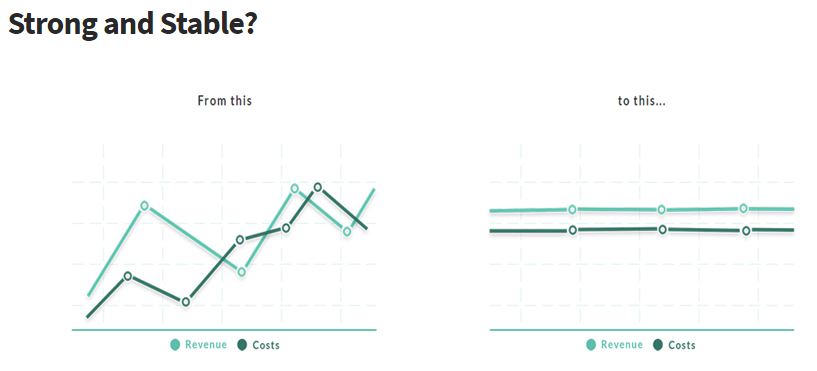

The products that we consider are put and call spreads. In a few papers, Dr. Assa has shown the universal optimality of these type of insurance contracts in many applications. Thus, we needed to work with these contracts and find the two optimal retention levels so that they can fairly manage the risk of clients and make the investment profitable. In this project, we needed to consider two ends of a new market, demand and supply sides. The demand for insurance is made by risk-averse farmers and farm-product consumers who are looking for better utility and the supply side consists of investors who invest in this business and issue insurance for making a higher profit. On one hand, we needed to convince clients that our product is a good enough product to manage the risk of volatile prices and on the other hand we needed to convince investors that there is a portfolio of the products that pay enough profit. To achieve this, we controlled key performance indicators according to market demand and supply and filtered the simulated products to achieve the optimal ones. We are now monitoring the performance indicators in our dashboard at real time on a daily basis; some of the key indicators are: Return over investment, Loss ratio, Exercised ratio, Farmer lose frequency, Investor lose frequency and Positive ROI ratios.